What is the status of Social Security and my retirement?

In 1930 the average lifespan of a man was 58 and for women was 62. In the beginning, the age at which citizens could begin to withdraw Social Security was 65. So what did this mean? It meant the government was hedging a bet that most would never live to draw Social Security. And, unfortunately, annuities did not exist in 1935.

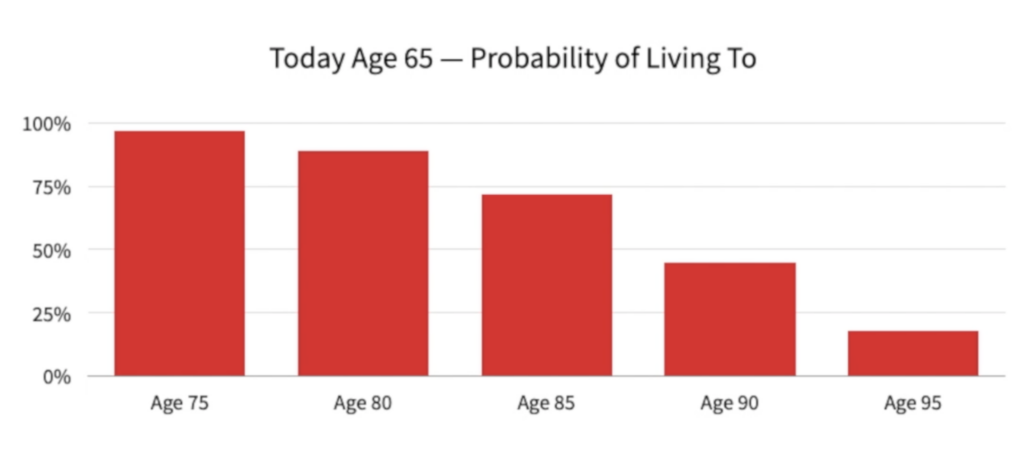

Review the following table to see just how long you might actually live. Have you planned your retirement to keep you supported beyond the age of 90?

Today, the aging numbers have grossly changed and Social Security appears to be nearing insolvency due to tremendous pressure on the system based primarily on improvements in health and the result of people living longer. Baby Boomers are moving into full retirement and those vast numbers are stressing a system that was never set up to handle such numbers. Additionally, the population is getting older, people are having fewer children, which is reducing the size of the workforce that funds Social Security. Investopedia.com has an interesting article on Social Security’s future.

For those are a bit unclear on Social Security, U.S. News published a recent article on myths of Social Security. From the perspective of Your Annuity Master, you need to establish retirement that falls outside the dependency on Social Security. It was never meant to fully fund retirement, but just to provide a base for retirement.

Retirement Recommendations

Your Annuity Master has several recommendations for those planning for retirement to leverage the pros and cons of Social Security as well as taxation issues.

- Diversify retirement accounts between qualified and non-qualified plans.

- Do not solely depend on a qualified plan through your work. Have your own IRA account (Roth or traditional).

- Consider annuities as an investment option to reduce your taxation at retirement, and provide guarantee a lifetime income stream during retirement.

- Consider moving funds out of a qualified plan to a Qualified Longevity Annuity Contract to reduce Required Minimum Distribution (IRS limits apply).

Arranging your retirement can seem overwhelming, but we have a way of simplifying the process to better understand, set-up, and manage. Taxation issues are often at the core of the planning. Two schools of thought exist on this; one states to always defer taxes so those dollars can be put to work today to increase returns. The other thought is to pay the taxes now, since you never what tax rates may be in the future. We feel a delicate balance between the two thoughts is best.